Logistics can deplete half of the operating costs of a mine, and even more. The transport of bulk commodities from ‘pit to port’ – or to the point of processing or consumption – is a fundamental cog in the mining supply chain that can be easily derailed and grind to a halt without a well-oiled logistics solution.

In Africa’s remote mine sites, this often involves fundamentals such as the design and construction of roads, railways and ports because the required infrastructure is dilapidated or simply non-existent. One way of lubricating the logistics supply chain (inbound and outbound) and removing inefficiencies is through outsourcing the project management to a third-party logistics (3PL) provider.

‘From extraction to delivery, mining companies use many different transportation modes, with requirements for specialised equipment and expertise,’ says PLS Logistics, a leading US-based 3PL firm in a white paper on mining logistics.

According to PSL: ‘Inbound moves can include a mix of LTL [less than load], full truckloads, flatbeds and multi-axle trailers. Outbound moves to processing plants and ports can use rail, barge and trucks. Co-ordinating and synchronising these moves is difficult and requires expertise across all modes. That knowledge is tough to come by, particularly if freight management is an add-on responsibility to another “full time” job.’

Hiring logistics specialists could significantly contribute to the success of a mining project – either by addressing one specific aspect of the mining company’s road, rail, air or sea transport chain, such as material handling, freight forwarding, warehousing, inventory optimisation, stockpile management or advising on local laws and regulations, among others; or by developing a complex end-to-end solution that covers all logistics needs and fully integrates subcontractors and other role players in one centralised network, co-ordinated via control towers.

A lead logistics provider, also known as fourth-party logistics (4PL), can become the interface between the mining company and one or multiple transport service providers, managing the entire logistics process. This allows the miner to focus on its core business: the extraction of precious metals and minerals from the ground.

In Africa, mining companies can choose from a range of world-class 3PL and 4PL providers with a strong local presence and global networks, such as Imperial, Barloworld, Super Group, Bolloré, DHL and many more.

The key advantages of outsourcing logistics project management are increased predictability and efficiency in terms of capacity, time and cost.

‘The true extent of the logistics costs depends on the commodity and the footprint of a particular mining operation, but the reality is that transport is very expensive in Africa,’ says Andrew van Zyl, partner and principal engineer at SRK Consulting SA – a global provider of mining solutions ranging from exploration and feasibility through mine planning and production to mine closure. In Africa, the group has a presence in Cameroon and offices in South Africa, the DRC and Ghana.

‘Essentially you may find yourself in a situation where logistics – which are not under your control – account for half of the business you are running while you’re hoping to make a profit on the remaining half,’ says Van Zyl.

The larger the operational footprint of a mine, the more complex, capital intensive and time-consuming the issue of logistics becomes. ‘For diamonds and gold, the footprint is fairly small,’ says Van Zyl.

‘It typically comprises the mine, tailings dam [for gold], office and staff accommodation and involves a manageable number of interactions with the stakeholders around the mine. The diamond grade is measured in carats per 100 tons of ore, so the end product fits in a suitcase and can be transported by helicopter.

‘Gold is similar in the sense that the mine can produce a substantial amount on-site and fly the gold bars out by plane. Mines tend to have their own landing strip. However, as you move from precious metals to intermediate metals such as copper or lead, where trucking is an option, towards bulk commodities such as coal and iron ore, which require bulk rail, the scenario’s complexity increases.

‘Mining operations start developing a substantial footprint, often becoming a strategically significant player in the host country’s economic landscape. As soon as you require a new railway line, the number of communities that need to be consulted grows exponentially to the distance of the line, and you need strong interactions with the government and regulators – sometimes involving more than one country. It’s a complex exercise that goes beyond much more than just the financial cost.’

According to Van Zyl, SRK was the technical adviser to the government of Cameroon in the Sundance iron ore project – potentially worth US$7 billion in a US$12 billion economy, where the envisaged 500 km heavy-haul railway would be the first rail line in several decades.

In South Africa, the dedicated mineral railway lines – Sishen-Saldanha iron ore line and Mpumalanga-Richards Bay coal line – are efficiently run by state-owned Transnet Freight Rail (TFR) and offer predictability in terms of logistics costs, capacity and performance.

One future beneficiary is, for instance, Resource Generation Coal (Resgen). Through its black-owned South African subsidiary Ledjadja Coal, it has negotiated with TFR to use its railway for export via the Richards Bay coal terminal, which necessitated the construction of a 51 km rail link from the mouth of its new Boikarabelo mine in the Waterberg to the main railway line. Furthermore, Resgen has partnered with the Limpopo Road Agency to upgrade provincial roads and connecting roads leading to the mine.

Logistics providers are increasingly forming partnerships for smart supply chain solutions within the mining sector that include road, rail and warehousing to identify the absolute best possible solutions that optimise transport cycle times. TFR’s memorandums of understanding with Barloworld Logistics and Imperial Logistics strive to migrate road traffic to rail in South Africa.

Mathys Enslin, managing executive: integrated freight solutions at Barlowold Logistics, says: ‘We have subsequently developed a similar service offering for opportunities within Africa with a strong focus on the design, development, operation and management of intermodal terminals.

‘Barloworld Logistics has recently entered into negotiations with the promoters of a potential game changer in the rail logistics space, this being bi-modal technology.

‘Bi-modal technology delivers a more seamless transfer of road cargo to rail by making use of bespoke road trailers that effectively transform into rail wagons, to eventually alleviate the need for large terminals or sidings.

‘This technology enables cargo owners to load directly into road trailers at its siding on the mine, with the trailers then being ferried to the nearest railhead where a train of these trailers will be assembled,’ he says.

Currently, rail-friendly bulk commodities are frequently transported by road instead of rail because Africa’s quality of rolling stock, locomotives and rail infrastructure negatively impacts the predictability of the rail solution offering, which in turn increases costs, according to Enslin.

In the SADC region, the established mines have agreements with rail operators in place with a smaller percentage of product being transported by road, to guarantee service levels, while the junior miners are more likely to transport all their bulk mined commodities on the road, according to Riaan Cronje, business development director: managed solutions at Imperial Logistics.

‘Our capability lies in creating end-to-end logistics solutions for mining companies. Our involvement includes multimodal solutions; inbound as well as outbound transport of consumables, equipment and mined commodities. One area where we see potential for expansion is the consolidation of mining consumables such as tools, spare parts and fast-moving consumer goods. There’s still value to be found.’

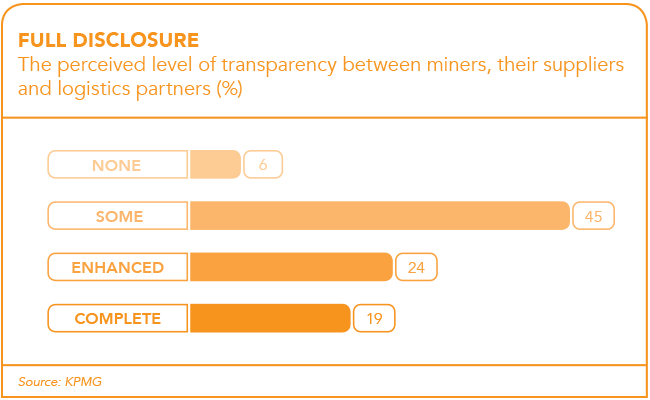

A crucial aspect of inbound and outbound logistics is seamless integration – whether a mining product is moved a few hundred kilometres from pit to port or thousands of kilometres to overseas markets. To achieve this, there needs to be transparency across mining companies, their logistics partners and ideally also their suppliers.

KPMG says in its 2016 Global Metals and Mining Outlook: ‘Metals organisations are worried about the potential for supply chain failures but most lack complete visibility into their supply network. In fact, 82% of metals executives in our survey say that supply chain failure is a risk and more than a third say it is a significant risk.’

It therefore makes sense to outsource the logistics function to a specialist provider that is able to streamline the mining supply chain and provide real-time visibility, tracking all freight on its route up or down the supply chain, in order to immediately spring into action should a problem arise. This way the mining company can direct its internal resources towards core mining activities while having the peace of mind that its logistics processes are running smoothly.